|

BRITAIN COULD GO BUST FROM DEBTS

Please use our A-Z INDEX to navigate this site

|

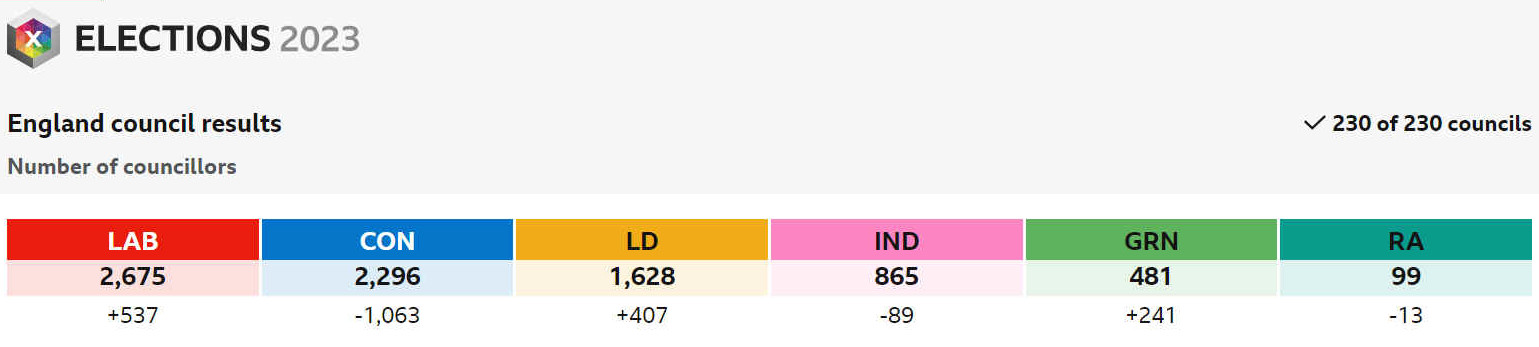

STATE OF THE NATION - The Green Party will have to work much harder if they are going to form an alliance with the Libdems in any general election. The results for the Greens in Wealden were staggering, as were the losses for the Conservatives with shamed leader Boris Johnson at the helm, lying to Parliament, lying to Queen Elizabeth and Lying to the electorate during his Big Red Bus campaign. How then was he voted in as Prime Minister, when so untrustworthy and demonstrably unreliable. Presumably, because of the under the table deals he was prepared to do. Covid fast track procurement fraud and cash for honours. When, in reality, he did not have a clue how to run the country, except to keep on borrowing, and building executive housing, so that the homeless, remained homeless, and the renting generation became extended to the next generation of slaves, to row Great Britain into yet more choppy water. With King Charles also coming under fire for his empty properties in a housing and cost of living crisis. The backbone of a nation is it's workforce. Those who physically carry the country forward with skills and services the ruling class shy from. It makes sense to reward workers with reasonable living conditions and equitable rewards. Not to enslave or shackle to the oars of financial servitude. To render them Galley Slaves, to the economic frauds so rampant in the UK. Thus, taxation in all forms needs to become totally transparent - so that the electorate can see what the governments, local and national are doing about the year on year deficit - doubtless fuelled by procurement fraudsters.

Unfortunately, simple solutions, like cutting the cost of living for millions of voters, with GENUINELY AFFORDABLE HOUSING - is something that eludes governments, once installed in power, they lose all incentive to change the political landscape to something more sustainable.

By way of example, the above diagram shows 12 building plots for 18' x 54' flatpack units - on a one acre site, to include parking, but not including an access road. Arable land is roughly £8-9k per acre. An uplift of 100% for compulsory purchase - on land earmarked for Low Cost Exceptions; self-build starter homes (NPPF). Sites thus acquired for villages, will yield plots for registered persons at around £1,670 per plot.

Now, this really is affordable stuff. Flatpacks are around £30-40k, with solar power, borehole/pump and waste treatment pack coming in well under £50k per home. Against which mortgage repayments are roughly £250 per month. And a reduction in Council Tax, to Band A, for those renting executive houses at over £9000 per month. Good news for the homeless, not so good for overpriced market dealers, and price fixing councils, who use their power to monopolize the planning system, to obtain higher rateable bandings - to pay their enhanced pensions. Such councils, dealing in human misery, might be deemed planning criminals, no better than King Charles II and his African Royal Trading Company, officially sanctioning slave trading.

https://www.msn.com/en-gb/money/other/britain-could-suddenly-go-bust-as-national-debt-is-now-bigger-than-entire-economy/ar-AA1cRZCz

SOARING FOOD PRICES - Nothing is more alarming than doing a shop, and finding the prices have literally doubled overnight. Then coming home to find the government are saying inflation is running at 10%. Energy prices are also ridiculously high, even though the UK could be energy independent, if we harnesses our wind turbines more effectively. And we need to build more, with energy storage in batteries or as hydrogen, or hydrogen compounds.

One way of beating food prices is to grow your own vegetables, and plant an apple tree. Cherries and grapes also grow in the south of England. For EV's park and charging prices, need to be regulated, to stop profiteering from electric motorists. We need to transition to renewable energy for transport, as well as for home heating. All of these things can combine to reduce imports, and lower our national debt. Provided that politicians pull our belt in and stop strutting around pretending to be doing good. We need policy changes to speed our national recovery, not promises. The sad thing is, those in power do not have what it takes to make new statute to get things moving the right way.

Please use our A-Z INDEX to navigate this site

|

|

|